Off-Exchange Services

Cboe's APA services for MiFID II.

The Key Features of the APA service include:

- Support for the equity and equity like universe of securities as specified in RTS1.

- Support for OTC reports in Swiss equity instruments by virtue of holding Trade Data Monitor Status with SIX Swiss Exchange.

- Support for deferred trade reporting as per the updated MiFID II ADT rules.

- A suite of web-based administrative tools.

- An open connectivity model permitting other vendors and APAs to pass trade flows into the Cboe APA.

- Trade submission is performed either via standard FIX interfaces or via the “Assisted Reporting Model” outlined below.

Benefits of the APA service include:

- Domain expertise by virtue of running a MiFID II pre-cursor to APA services.

- Firms who are Participants of Cboe Europe can utilise their existing physical infrastructure.

- Wide distribution of trade data to data vendors and trading firms.

- Benefit from many large firms’ intention to utilise Cboe’ APA services.

Direct and Assisted Reporting models.

Direct Reporting

The Direct Reporting model is the standard model where firms can themselves submit trades electronically via a FIX or BOE interface. For technical information relating to the interfaces please see our Technical Specifications & Connectivity document library.

Assisted Reporting

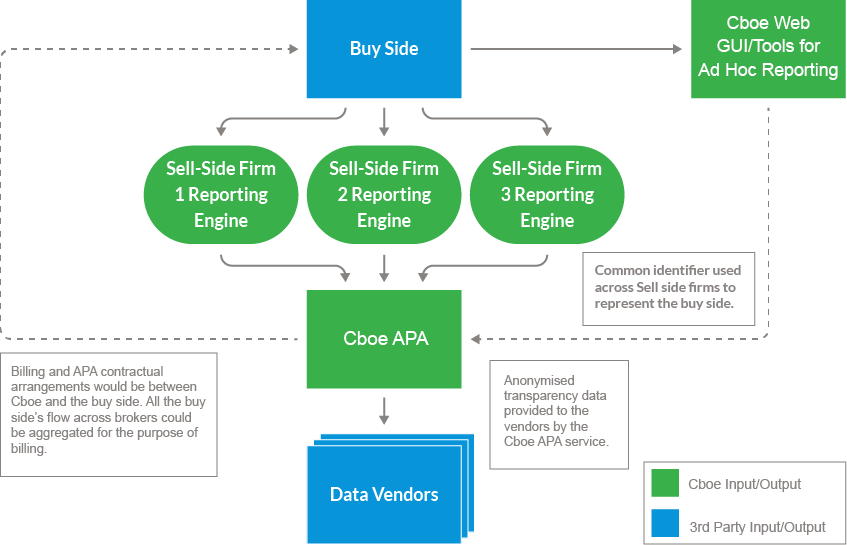

The Assisted Reporting model permits Investment Firms (typically buy-side) to utilise the technology of counterparties to assist them in meeting their regulatory responsibilities.

Under this model, firms would require a standard contractual relationship with Cboe and be subject to the standard pricing.

Key Advantages

- Buy side – Provides a low-cost, lightweight solution for trade reporting obligations

- Buy side – reduced integration and ongoing costs (connectivity, ports)

- Buy side – APA delivery risk reduced

- Buy side – access to full range of tools as if they were directly connected

- Sell side – changes to reporting logic would be more limited than if many buy side decided to report themselves when required

- Both buy and sell side – limits scope for proliferation of equity APAs, commercial and technical costs associated with re-aggregation of data from many sources

The diagram below illustrates the Assisted Reporting model.

Key Service Documentation

- APA Service Description

- Trade Reporting Services Agreement (for non Participants of Cboe)

- Trade Reporting Services Order Form

- Trade Reporting Addendum (for existing Cboe Participants)

- Assisted Reporting Onboarding Factsheet

MTF Reporting

The MTF Reporting service provides MTF operators a facility to disseminate trade reports to the major market data vendors via Cboe’ outbound market data feeds. The underlying venue is identified on the trade reports enabling vendors to correctly attribute market share to the venues.

MTF trade reports can be submitted through existing connectivity to Cboe.

Please note: Subscribers do not need to be Participants of Cboe, but will need to enter into appropriate contractual arrangements.

Key Service Features

- Trades are attributed to the dark venue on market data feeds.

- Entry is made via standard FIX interfaces. Firms who are Participants of Cboe can utilise their existing infrastructure.

- A user of the MTF Service does not need to be a Participant of Cboe, but will need to enter into appropriate contractual arrangements.

Systematic Internaliser Quote Service

The SI Quote Service provides a mechanism for registered SIs to meet their MiFID II OTC pre-trade transparency requirements. All trade reports associated with the SI regime are required to be reported in accordance with MiFID II reporting rules and flagged as SI trade reports.

SI quote data will be subject to automatic price checks to ensure data quality.

The SI quote data is disseminated on the Cboe market data feeds and is available via major market data vendors.

Please note: Subscribers do not need to be Participants of Cboe, but will need to enter into appropriate contractual arrangements.

Key Service Features

- Operates as a standalone quote service separate from the order book, and requires the firm to make at least a one-sided indicative and attributed quote.

- All trades entered into as a result of the SI Quote Service will be reported under the APA service and flagged as SI.

- Such trades will be reported in real-time, subject to any large in scale deferred reporting waiver, but will remain off-exchange, un-cleared and subject to bilateral settlement.

- Trades do not need to be validated but Cboe will perform automatic price checks to ensure data quality.

- A user of the SI Quote Service does not need to be a Participant of Cboe, but will need to enter into appropriate contractual arrangements.