On-Exchange Services

Cboe Europe Equities' Exchange Trade Report (ETR) service enables trading Participants to transact bilateral pre-negotiated trades on-exchange. The ETR service provides an efficient way for customers to report trades and utilise existing clearing and settlement arrangements with Central Counterparties (CCPs).

The Cboe ETR service can be used by any trading Participant of Cboe through one of the following trade types:

Single Party ETR

Multi-Party ETR

Key Service Features

- Post-trade settlement and margin savings from netting ETR trades with Cboe order book trades

- Alternative trade reporting solution for firms that cross their client business; all trades reported by Cboe

- Accessible via existing connectivity to Cboe

- Supports regulatory requirements related to bringing trades on-exchange and into central clearing

- Reduction in counterparty risk by turning a bilateral pre-negotiated trade into an on-exchange CCP-cleared trade

- Available for use in any of the pan-European markets tradable on Cboe

- Participants can choose Cboe Clear, LCH or SIX x-clear as their CCP

- Ability to suppress clearing where there is no net settlement required on the trade (Single Party ETR only)

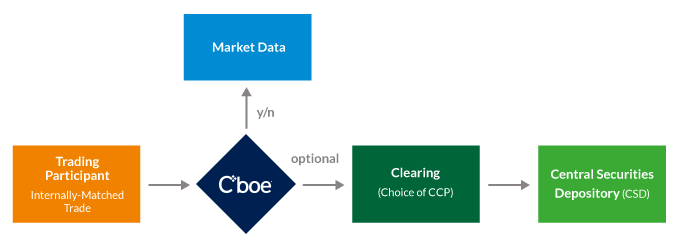

How the Single Party ETR service works:

- A trading Participant matches a trade between two clients or as a principal against a client.

- The trading Participant uses its existing connectivity into Cboe to submit an ETR in real-time or as part of an end-of-day netted position.

- The ETR is a single FIX or BOE message comprising the buy and sell side of the trade at the same price and size

- The trade is validated and then reported* on the CXE or BXE trade feed as a Negotiated Trade (NT)

- Cboe identifies the trading Participant's CCP and sends the trade to it in real-time for risk management purposes and netting with existing Cboe order book trades.

A Single Party ETR is classified as an on-Exchange trade report referencing a single legal entity (and the same Trading Identifier Code).

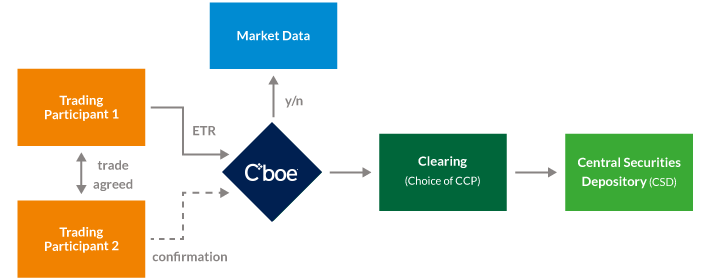

How the Multi-Party ETR service works:

- Users of the Multi-Party ETR service must first complete the Cboe Counterparty Trust Matrix, identifying Cboe trading Participants with whom they agree to use this service.

- A Cboe trading Participant agrees a trade with another Cboe trading Participant bilaterally. The two parties agree to bring the trade on-exchange through the Cboe ETR service.

- The selling counterparty (unless agreed otherwise) submits an ETR to Cboe, identifying the other counterparty to the trade.

- Cboe validates both counterparties to the trade, acknowledges the trade to the submitter and sends a drop copy of the trade to the counterparty against whom the trade is being alleged.

- Once validated the trade is reported* on the CXE or BXE trade feed as a Negotiated Trade (NT).

- The Cboe trading Participant against whom the trade is being alleged is not required to positively acknowledge the trade to Cboe, but can contact Cboe to invalidate the trade if required.

- Cboe sends the trade to both trading Participants' CCP(s) in real-time for risk management purposes and for netting with existing Cboe order book trades.

- Interested Cboe trading Participants are required to pass a certification test for this new functionality before enablement in Production. Please contact the Trade Desk to schedule a formal certification test.

A Multi Party ETR is classified as an on-Exchange trade report referencing different legal entities (or different areas of the same legal entity).

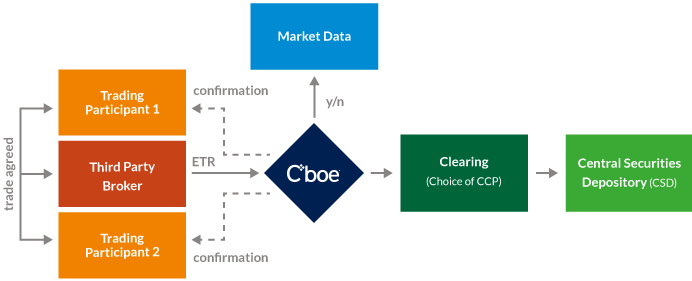

Third Party Broker ETR

The Third Party Broker ETR means a Cboe Participant acting as an Arranging Broker (as defined within the Cboe Rules), negotiating an ETR trade on behalf of two other Cboe Participants, but who is not counterparty to the resulting negotiated transaction.

How the Third Party Broker ETR works:

Users of the Third Party Broker ETR service must be Cboe Participants, have signed a Third Party Trust Matrix with the Third Party Broker and passed Cboe conformance testing.

The Third Party Broker will match transactions in their own systems and send Cboe a single ETR message, identifying both counterparties to the trade. Both counterparties will remain anonymous to each other throughout the post-trade process.

Cboe will process the message and where accepted, send acknowledgements to the Third Party Broker and both counterparties.

Once validated the trade is reported on the CXE or BXE trade feed as a Negotiated Transaction.

Cboe sends the trade to both trading Participants’ CCP(s) in real-time for risk management purposes and for netting with existing Cboe order book trades.

ETR Trading Hours

Please visit the Hours and Holidays page for ETR trading hours; they are detailed in the Cboe BXE and CXE Order Book Environments section.